Posted , in Featured

Our recent report, Intelligent Analytics:Threats and opportunities in the global analytics market, reveals that, collectively, consulting firms currently only have a 25% share of the analytics market. The remaining 75% is being done in-house, by clients themselves.

That ought to bring the focus of most consulting firms—beating their fellow consulting firms to the analytics prize—into sharp relief. Instead of slogging it out with each other to work out how they divide up 25% of the market, perhaps they should be focused on the bigger prize that would come from persuading clients to do less in-house.

But how can they do that? With this question in mind, we’ve mined the data we’ve gathered from senior end-users of consulting in the US* to see if there are any clues.

We ask clients to rate a firm’s data & analytics work and, later, to rate the same firm on a series of attributes—a collection of things ranging from what it’s like to work with (Is it responsive, is it quick to deliver, or what’s the culture like?) to things like price point, quality of experts, and account management. Using regression tree analysis, we found that high performance in certain attributes produced a higher rating for data & analytics work. We also found the reverse—the attributes a firm can’t afford to mess up if it wants to build its reputation in this area.

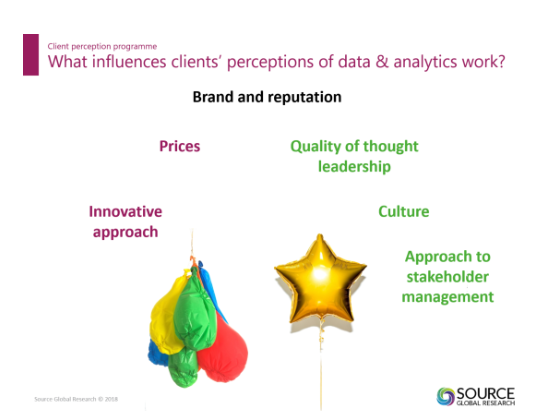

The first attribute to get right is brand and reputation. It’s at the top of the tree because it produces the greatest split in opinion. If a US client rates a firm’s brand as “good” or “very good”, it nudges up the score given for data & analytics capability. After that, the next most decisive factor is the quality of a firm’s thought leadership: If a client rates this as above-average, it pushes the firm’s data & analytics score up further. The very highest scores go to firms that do both of those things and also impress clients with their culture and their impeccable stakeholder management skills. Get these things right, and a firm may well convince clients that it should be trusted with more of this type of work.

Conversely, if a client thinks a firm’s brand and reputation is average or poor, it pushes data & analytics scores downward. If clients speak negatively about a firm’s price point, that too negatively impacts the score it gets. Finally, if a firm is seen to be very poor for its innovative approach, it’ll earn itself the poorest rating of all in data & analytics work. Get these attributes wrong, and a firm can lock itself out of not just the analytics work done by consulting firms, but the bigger prize—the work clients do themselves.

*Based on the views of 735 senior end-users of consulting services in the US, surveyed in November and December 2017.