Posted , in Featured

in Brand

We’ve written before about the ‘magnetic middle’ effect, in which clients of consulting firms struggle to differentiate between firms based on the quality of their work alone. Very little separates the top-rated firms from the bottom-rated ones, with firms deliberately making acquisitions and investments to ensure they provide the full suite of services their clients need to a high standard. If this is the case, why are we even talking about quality anymore?

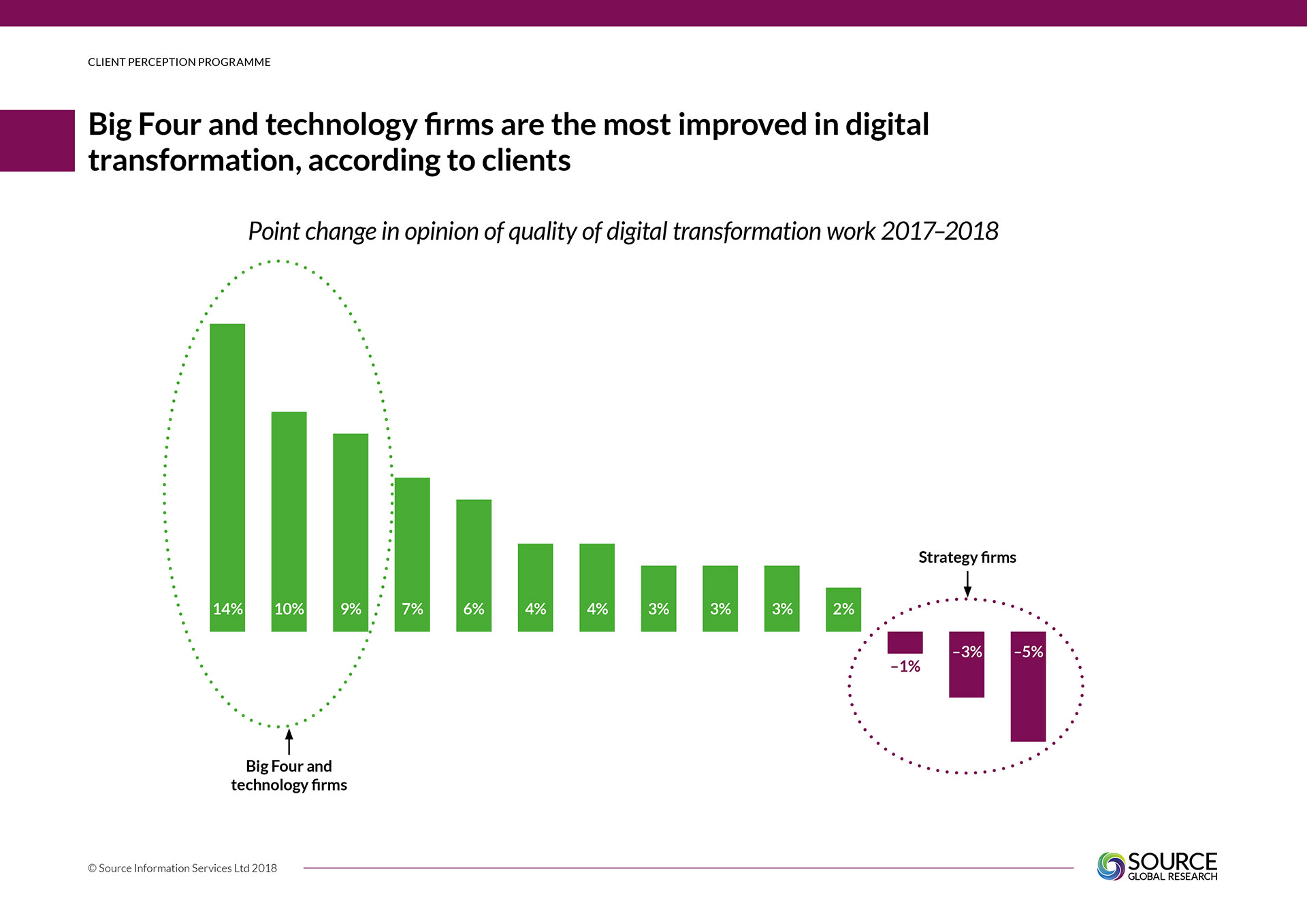

Well, looking at how individual firms performed this year versus last in our annual survey of consulting clients* shows that there’s no room for complacency, particularly when it comes to digital transformation. Firms may have ended up scoring very similarly to each other for the overall quality of their work this year, but some have taken great strides forward in digital, while others appear to be moving backwards.

At the most improved end of the scale, we see two of the Big Four feature alongside what we call a technology firm (a consulting firm which also has a large, pure technology business). In the middle, clients largely see a set of firms with digital work improving at about the same rate as the market average, and at the other end, three strategy firms where clients see varying degrees of decline in the quality of their digital work.

What’s also striking about the firms at either end of the spectrum is that none have invested in a separate, digital sub-brand, from which a number of possible conclusions arise:

Of course, a lot can change in a year. It’ll be interesting to see if the firms that have improved significantly this year can maintain an upward trajectory, or whether strategy firms going into reverse have changed clients’ minds. Our next round of research is about to begin, so we’ll find out soon.

*In November and December 2017 we surveyed 3,197 senior buyers of consulting services across the world.